JPMorgan Chase CEO Jamie Dimon on Thursday revealed that the banking giant lost a $2 billion due to a massive trade that went sour, and that the losses could climb by another $1 billion in the coming days. Mr. Dimon said on Thursday that JPMorgan’s “synthetic credit portfolio,” an amalgam of derivatives and hedging bets that blew up in recent weeks, was part of “a strategy to hedge the firm’s overall credit exposure.”

Several days after announcing a $2 billion loss in its chief investment office, JPMorgan Chase is clearing house. Matthew E. Zames, the JPMorgan executive, was tapped Monday to replace the outgoing chief investment officer, Ina Drew.

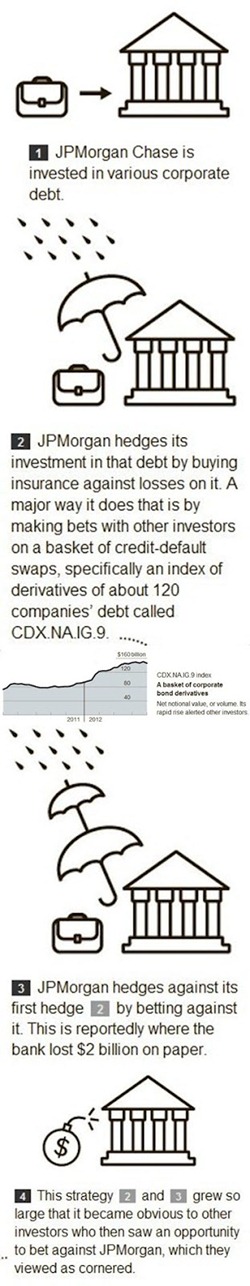

The bank most likely structured the trade in a way that magnified losses (see the image). Read more “JPMorgan's Appalling $2 Billion Loss”

(The illustration is a courtesy off The New York Times)

No comments:

Post a Comment