S&P cuts outlook on J.P. Morgan to negative

Standard & Poor's said late Friday it lowered its ratings outlook on J.P. Morgan Chase to negative from stable because of the bank's unexpected

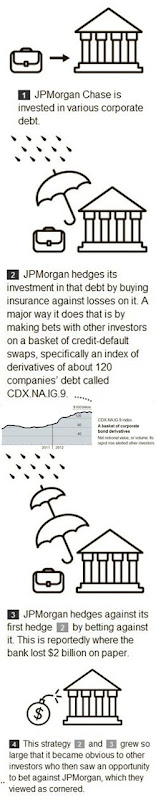

$2 billion loss on derivatives. S&P kept its A/A-1 issuer credit ratings on the bank and its A+/A-1 ratings on its subsidiaries.

S&P said it could lower its ratings by a notch if its determines that risk management mistakes were not limited to the specific credit portfolio mentioned late Thursday, or if it believes management is pursuing a more aggressive investment strategy than originally believed.

Fitch downgrades J.P. Morgan after trading loss

Fitch Ratings said on Friday it downgraded J.P. Morgan Chase & Co.'s long-term credit rating to A-plus from AA-minus, saying that while the $2 billion trading loss disclosed by the bank on Thursday is "manageable," the potential reputational risk and risk-governance issues raised are no longer consistent with an AA-minus rating. "The magnitude of the loss and ongoing nature of these positions implies a lack of liquidity," Fitch said in a statement after the stock market closed. "It also raises questions regarding J.P. Morgan's risk appetite, risk management framework, practices and oversight; all key credit factors."

Stock market reaction

Shares of J.P. Morgan closed down 9.3% on Friday and slipped further in after-hours trading.

U.S. stocks mostly slid Friday to a second weekly decline after a rise in consumer sentiment failed to outweigh J.P. Morgan Chase & Co.'s $2 billion trading loss, disclosed by the bank late Thursday.

The Dow Jones Industrial Average fell 34.44 points, or 0.3%, to 12,820.60, off 1.7% from the week-ago close. The S&P 500 retreated 4.6 points, or 0.3%, to 1,353.39, down 1.2% for the week. The Nasdaq Composite managed a fractional gain to close at 2,933.82, down 0.8% from last Friday's finish

The U.S. government posted its first monthly budget surplus of $59 billion in April since September 2008, thanks to increase in tax receipts and decrease in spending on education, Medicare and certain defense programs.

The U.S. government posted its first monthly budget surplus of $59 billion in April since September 2008, thanks to increase in tax receipts and decrease in spending on education, Medicare and certain defense programs.