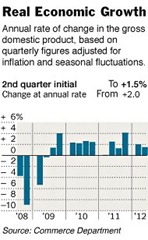

The latest government statistics showed that the United States economy expanded by a simply 1.5 percent annual rate in the second quarter. It has lost the momentum it appeared to be building earlier this year. The government also provided on Friday a revised figure for first-quarter G.D.P., saying the economy then grew by a 2 percent annual rate. The previous estimate was 1.9 percent.

The latest government statistics showed that the United States economy expanded by a simply 1.5 percent annual rate in the second quarter. It has lost the momentum it appeared to be building earlier this year. The government also provided on Friday a revised figure for first-quarter G.D.P., saying the economy then grew by a 2 percent annual rate. The previous estimate was 1.9 percent.

The economic growth, as measured by the gross domestic product, lagged as consumers curbed new spending and businesses held back. Consumers increased their savings rate, a sign of increased uncertainty about the future. Several bright spots in the first three months of the year, including auto production, computer sales and large purchases like appliances and televisions, dimmed or faded away altogether in the second quarter, and government at all levels continued to cut spending. Growth was not strong enough to drive down the unemployment rate, which has stalled above 8 percent in recent months.

Exports accelerated in the second quarter despite more recent signs of diminishing demand, but the gain was canceled out by a larger increase in imports, which count against the gross domestic product. Economists expect exports to shrink as the dollar rises against other currencies, making American goods less competitive.

The housing sector, which has gone from a drag on the economy to a positive, continued to grow, posting a 9.7 percent gain, though it is less than half its rate of growth in the first quarter.

Inflation, a measure watched closely by the Federal Reserve as it determines whether to take further action, slowed as well, with consumer prices growing only 0.7 percent compared with 2.5 percent in the first quarter.

The Commerce Department also released updated estimates of economic activity for 2009, 2010 and 2011. Those figures showed that the recession was less severe than it seemed in the most recent reports. The new estimates show that economic activity fell by 3.1 percent in 2009 and then rose by 2.4 percent in 2010. Last summer, the government reported that activity fell by 3.5 percent in 2009 before rising 3 percent in 2010. The estimated pace of growth in 2011, 1.8 percent, remained basically unchanged. It was previously reported as 1.7 percent.

The agency now estimates average annual growth of 0.3 percent over the three-year period, rather than 0.4 percent.