Greece’s debt problems are not new. The country had high debt as percentage of GDP, even as it prepared to join the euro zone in 2000. Italy and Belgium have long wrestled too with large debt loads. The debt-to-GDP ratios of Greece and Italy have been dangerously high, which are 109% and 103% respectively, since 2000.

Rising spending on the social safety net and other government programs has increased sharply over the last decade, pushing debt levels higher across the continent. Britain’s government spending as a percentage of GDP hit a 10-year high in 2008.

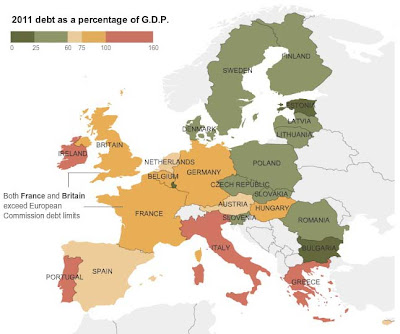

In 2011, fourteen of the 27 European Union countries face debts equal to more than 60 percent of their gross domestic product, the limit set by the European Commission. Greece, Italy, Portugal, and Ireland carry the highest debt burden with debt-to- GDP ratio above 100%. The debt levels of the region’s biggest economies, such as Britain, France, and Germany, fall between 75% and 100%.

No comments:

Post a Comment